Reviewing Masterworks: Interesting service, difficult market

December 13, 2021

Disclaimer: I’m not getting paid for this article.

Some time ago, I was reminded of Masterworks and finally decided to do some digging to decide if it might be a worthwhile investment. In case you don’t know, Masterworks is a crowdfunding platform where investors pool their money to buy shares of “blue-chip” paintings, hold them for 5 to 7 years, and resell them at a profit. The idea is appealing: Expensive and exclusive art seems to outpace the stock market. Allowing regular investors to join is a great idea. But as with every investment, they are risks and tradeoffs. Here is my take.

What return to expect: Can we beat the market?

Let’s start with their most appealing claim: The 13.6% return of art — well above the stock market. We can ask ourselves two questions:

1. Can we expect art to continue beating stocks?

They are some caveats to this 13.6% return: It only applies to the last 27 years and looks at contemporary artists (with artwork published after 1945). This is great, but I think most people would agree that art returns can’t, on average, beat stocks in perpetuity. Otherwise, nobody would have enough cash to buy those paintings. For this reason, I would expect the trend to invert at one point, but who knows if this will happen in 10 or 50 years. Looking at the past, we can find periods where art returns were lower than stocks. I looked for return numbers and they vary a lot: In Financial Market History page 90 and 91, we can see the return of art from 1900 to 2014 is closer to 3% compared to 7.1% for UK stocks. Those are significant differences!

On a general note, why would those returns be so high in the first place? If the risk-adjusted returns of art were higher than for other investments, wouldn’t rich people drive up the price to where it should be? Masterworks could also skip regular investors entirely and only work with hedge funds or family offices, which is a lot easier than dealing with hundreds of thousands of small investors and the SEC. I think this is explained because the risk of investing in art is high. Not all post-war and contemporary artists famous 15 years ago still are today: Decisions on what to buy matter a lot. In this regard, Masterworks does help a bit, but I doubt someone with basic art knowledge like me would make informed decisions. High net worth individuals can already include art in their portfolio up to their risk tolerance. What Masterworks is doing is popularizing art investment funds. Existing solutions require a significant amount of work and capital (usually around $100k) to get started and sometimes have other caveats that prevent almost everyone from using them. If you want to invest in fine art, Masterworks is objectively significantly easier. This allows them to create this new market and get management fees from investors that wouldn’t have used traditional art funds.

2. Can we expect to match the market return?

To match the art market return, we need an art index fund. Art indexes do exist, the most popular being Artprice100. It works by identifying “the 100 top-performing artists at auction over the previous five years who satisfy a key liquidity criterion (at least ten works of comparable quality sold each year). The weight of each artist is proportional to his/her annual auction turnover over the relevant period.” Overall, it makes sense and should make it possible to notice the overall price changes of the blue-chip artwork over time. However, how would you track this index with your investments? Artists join and leave the list every year, which means you need to rebalance, which is impossible to do when you’re invested in a couple of paintings you are supposed to hold for up to 10 years. This is confirmed by the fact they are no art index funds.

An alternative would be to invest in as many paintings as possible. Masterworks has new offerings every 3 to 4 weeks, meaning you could invest 15 paintings per year on average. Repeat three years, and you have a portfolio of 45 paintings. That’s some diversification, but we’re still vulnerable to a few paintings’ unexpected changes in valuation (imagine discovering an artist is a misogynist, or worse).

Correlation between stocks and the art market returns

Another benefit highlighted by Masterworks is it reduces the volatility of your portfolio as art supposedly isn’t correlated to the stock market. This can be read in the study Buying Beauty: On Prices and Returns in the Art Market. Even though some researchers disagree with this claim (here is a paper finding the confidence intervals for correlations estimates are so wide it’s hard to make predictions, however, this study isn’t as broad), I also tend to believe the correlation is low. This makes intuitive sense: Billionaires do not panic sell paintings in a downturn.

Let’s assume the art market isn’t correlated with stocks. We still run into the problem of diversification: Unlike stocks where it is trivial to own thousands of stocks concurrently with an index fund, Masterworks requires investors to manually. This significantly increases the role of luck in your return but also makes it hard to ensure you’ll get the hopped reduced volatility.

Fees and other costs

But let’s take a 13.6% return for granted. We should look at all the fees and costs to ensure they make sense. Masterworks charges a 20% carry fee on the sale’s profits (they are incentivized on the success, which is good) and 1.5% every year in the form of equity. This means that you give away a portion of the shares of the painting every year. They only see the cash from the shares when the painting is sold, aligning incentives. Those fees might seem high, especially compared to your average S&P 500 ETF, but I would say they seem fair when compared to typical art investment funds. Those funds have investment fees usually slightly higher (2 to 2.5%) and have the same carry fee (although it sometimes only applies after a specific return has been met). Some even have subscription fees reaching 4% (!!). Initially, I thought this wasn’t the case for Masterworks. However, as we’ll soon see, they have something similar, but at an even higher rate.

Another cost to keep in mind, buying and selling the artwork isn’t free: Auction houses have buyer fees (or premiums as they call them) of more than 14% for $10M+ paintings. I couldn’t find public numbers for sellers, and although it does appear cheaper, it seems reasonable to think it’s between 5 and 10%. This is huge and would have to be deducted from the return. However, Masterworks seems to always be acquiring paintings in privately negotiated transactions. I don’t know the full implications of this, but at least it must prevent most of the usual premiums.

Abstraktes Bild 940-7 (2015) by Gerhard Richter. The painting in Masterworks 075, LLC.

Abstraktes Bild 940-7 (2015) by Gerhard Richter. The painting in Masterworks 075, LLC.

While reading one of the Offering Circulars, I was surprised to notice an expense that isn’t described anywhere: A True-up Payment which is “intended to be reasonable compensation for Masterworks’ services, capital commitment and outlay in sourcing and acquiring the Painting.” For Masterworks 075, LLC, the company holding a $11,322,000 Gerhard Richter painting, this fee totaled $1,122,000 or around 10%! That such a fee exists doesn’t shock me: Buying a painting has costs (for both the transaction, which would have been more than 10% at auction and for the search). Masterworks also needs some cash flow while they wait for the painting to be sold to get their management fees. So is 10% too much? I’m not sure. In any case, they should make this fee more transparent. At the moment, its amount only appears on page 9 of the filing (let’s be real, most investors will miss it).

Calculating your return net of fees

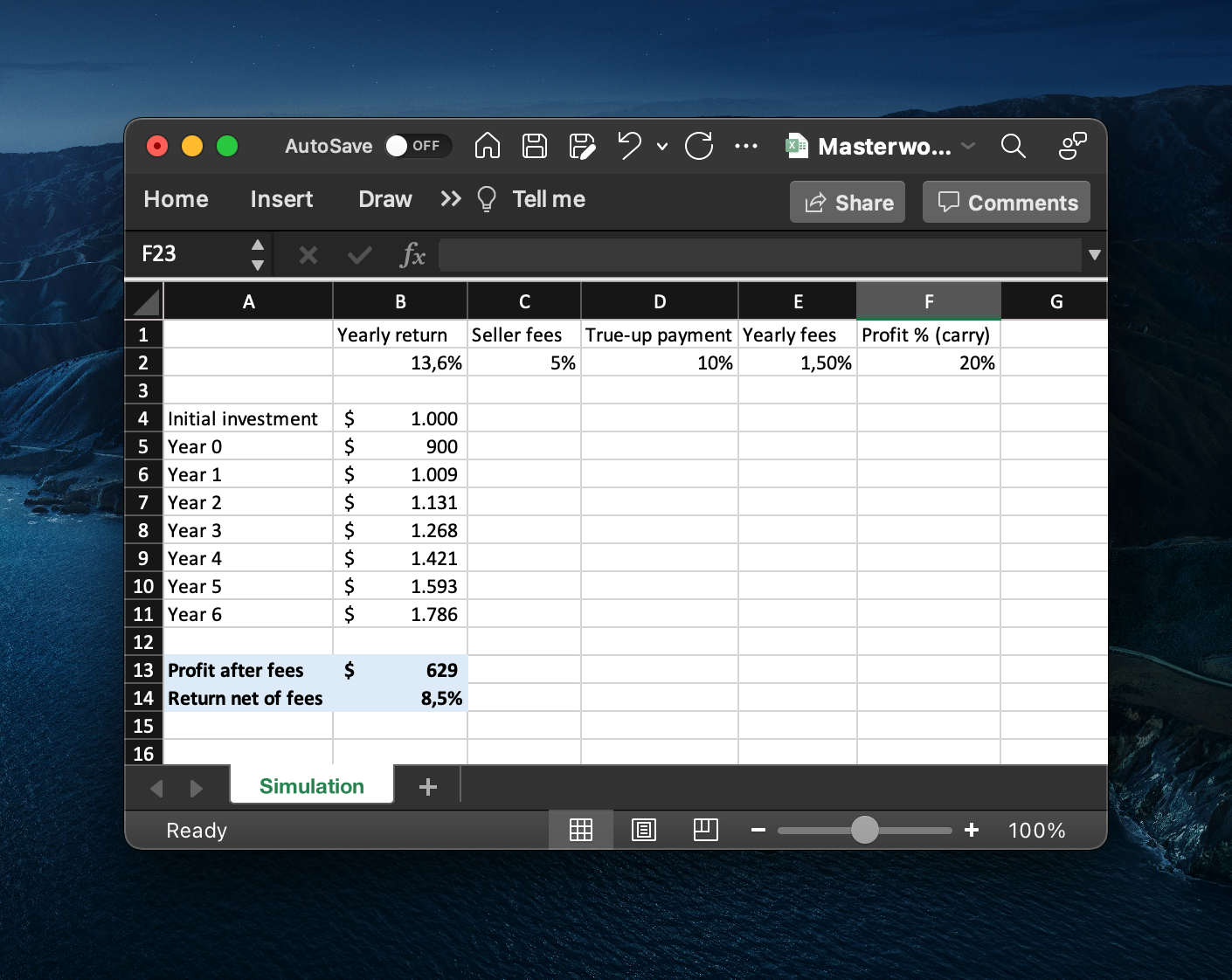

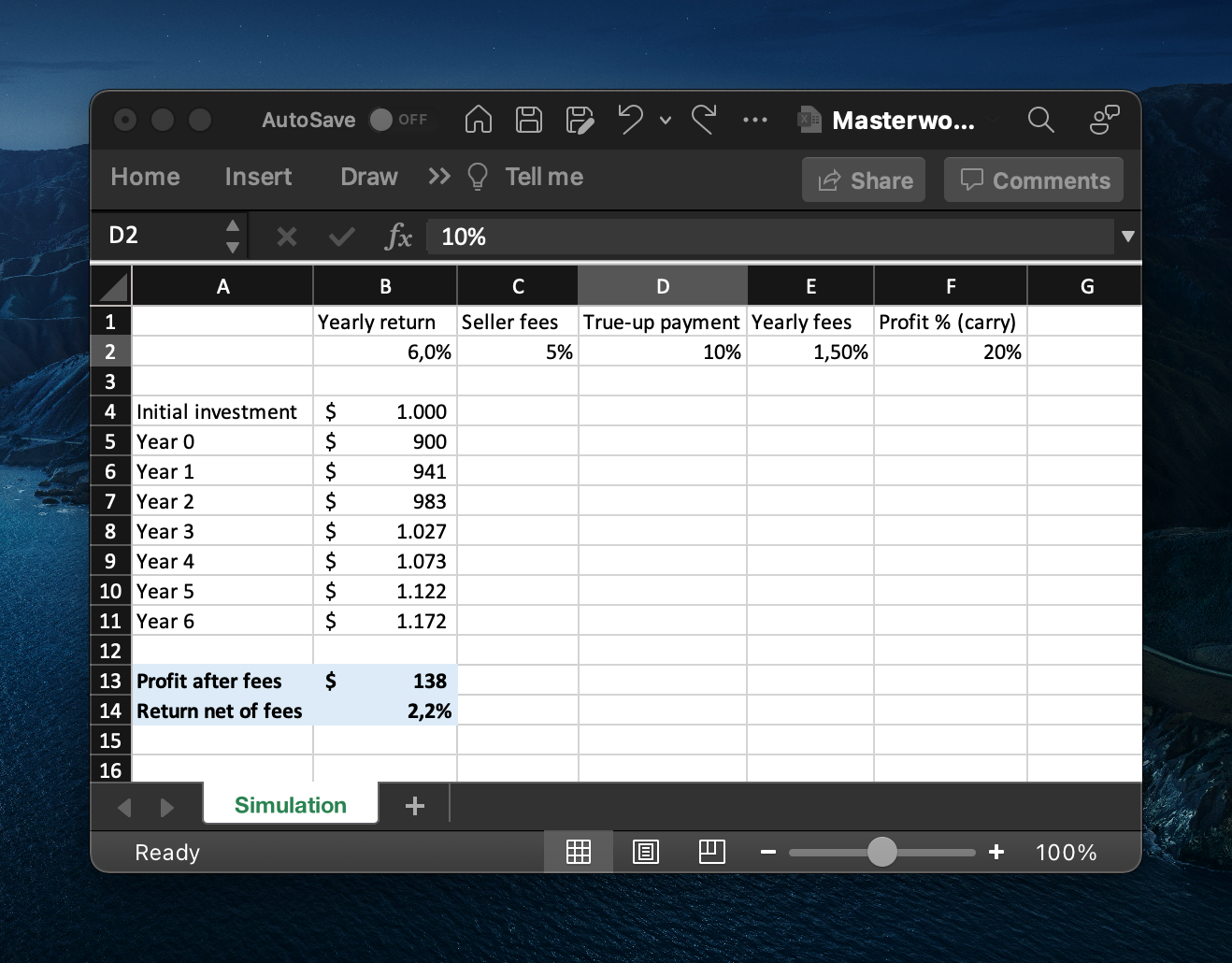

To make a decision, we need to get the return net of fees and costs. Here is a simple simulation (download it to tinker with the values):

As we can see, with the optimistic yearly return of 13.6%, we arrive at a return net of fees of 8.5% before taxes. This is lower than the reference 9.5% S&P return. Things get even worse if the yearly return goes down. With a 6% yearly return and a holding period of 6 years, your return net of fees is only 2.2%. Those fees really add up!

However, Masterworks might still belong in your portfolio depending on the return you would expect stocks to have in the future. You can play around in the Excel spreadsheet to see in what scenario an investment would make sense for you.

Investment structure: Where does your money go?

As with every investment, it’s essential to understand its structure better to assess potential risks. I regret that Masterworks doesn’t have a help section to guide their investors. However, they still provide a lot of information for those willing to do some work.

For every painting, Masterworks creates a new Delaware-based LLC. When you purchase shares in a painting, you buy shares in the LLC. As part of this process, Masterworks files an Offering Circular with the SEC (this is a big plus for me: more transparency and accountability is what you want). Here’s one example for Pablo Piccasso’s Homme Assis. If you invest in Masterworks, you need to read this document. I found it very easy to understand and relatively straight to the point, often the case with a prospectus.

Overall, the financial setup seems good. Having the paintings in separate LLCs ensures that if something happens to Masterworks (companies go bust every day!), you don’t have to fear for your investment. Of course, the holdings are tightly tied with Masterworks, and in such a scenario, I would expect the painting would have to be liquidated promptly. Not being able to time the sale would most likely be bad news for the price. But all things considered, it still feels like a decent outcome.

November 2022 update

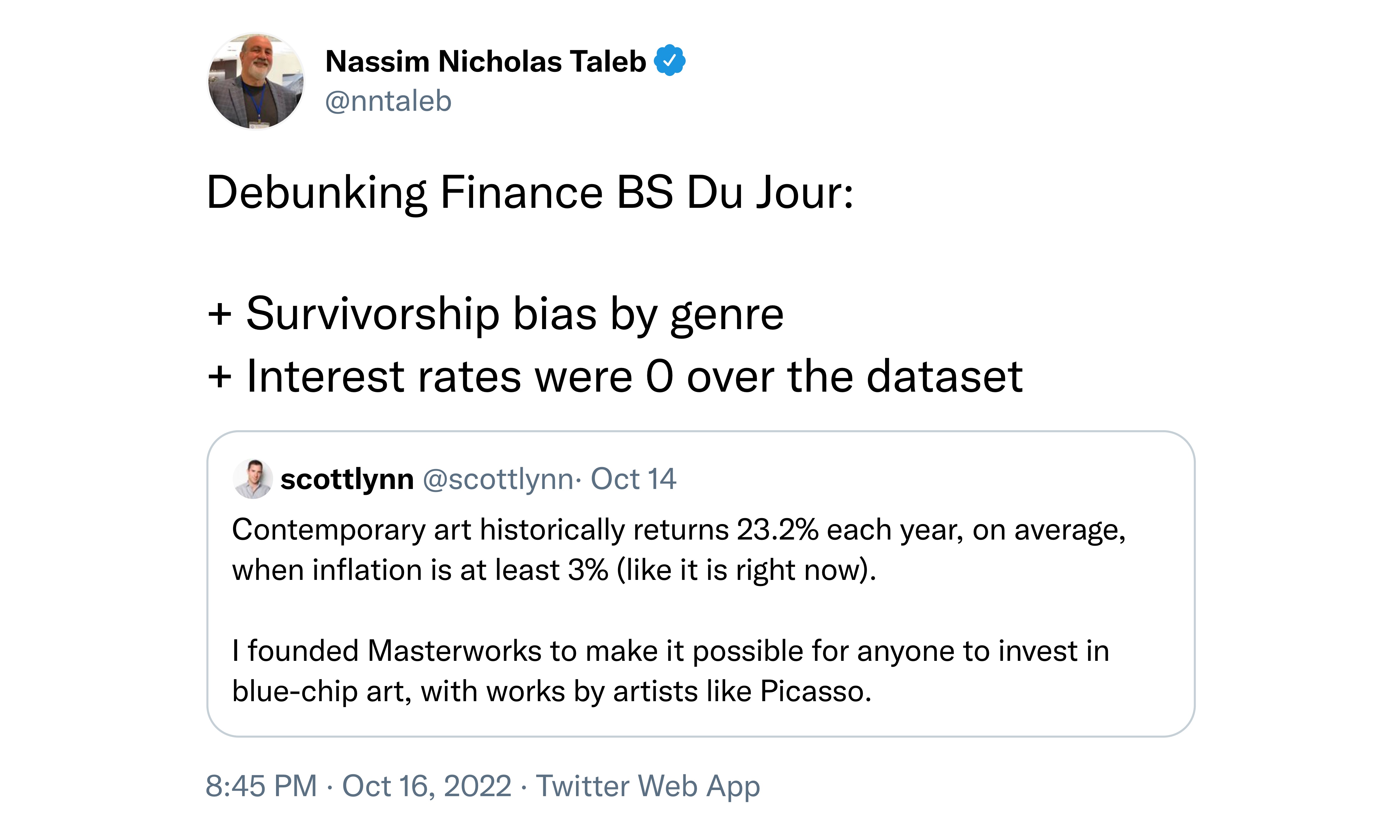

Nassim Nicholas Taleb made an additional interesting point: What makes contemporary art special? Why not invest in sculptures from the Renaissance? Or any other category of artwork? There does seem to be a selection bias at play here. Out of all the art categories, it’s expected that some would perform very well at any given time, but it doesn’t mean it will be maintained.

Conclusion

In summary, I like Masterworks, but I’m not sure I like the art market and its constraints.

As I explained, I don’t think the high returns are necessarily sustainable, and regardless, the low number of investments will lead to substantial deviations from this average. Additionally, you are the one choosing those couple of investments. Masterworks provides a few data points and explanations regarding why they think the investment makes sense, which isn’t enough to make an informed decision. If you’re going to invest, you, therefore, need to either believe in the Masterworks picks or you’ve done your research. However, with stocks at all-time highs, diversifying makes sense, and it might be better to invest somewhere instead of keeping the cash in your account and having it lose value thanks to inflation.

As for Masterworks itself, I like the way they operate, and the transparency one has with Offering Circulars they filed with the SEC. As you are investing long-term and they are a young company, there is some additional risk. But the biggest hurdle for me is fees (10% upfront, 1.5% yearly, and 20% on profits, all of this before taxes!). Art needs to vastly outperform stocks for the investment to make sense.

So, will I be investing? If I’m entirely rational, I shouldn’t. I don’t know enough about the art market to make good picks. I could go around this problem by investing in every painting they offer, but it would take me around three years to reach 50 investments, which is too much work compared to the uncertain upside. As I like the concept, I’ll still keep an eye on their offerings, and if I see a cool painting, I’ll give it a try out of curiosity. Plus, it’s a great conversation starter!